FreshFocus Produce Posting Rules

Overview

Produce Posting Rules in FreshFocus work with Trade Accounts and Produce Agreements to ensure relevant costs, charges and deductions are being accounted for in connection with produce items.

Produce posting rules provides for a flexible configuration and assignment of costs and recharges where you can define various filters, apply effective dates, configure the basis rates for any trade accounts that have been setup, and apply these rules to different combinations of produce items and properties.

The Produce Posting rules engine is the intersection of five key themes in produce costing

- Trade Accounts being the the definition of the type of charge including where the charge should be posted in the G/L.

- Movement Types being the transaction that triggers a charge to be calculated.

- Posting Rule Treatments being the definition for each payback method and rule whether a charge is applied or not.

- Rates and Calculations being the definition of how much to charge for a given tracking entry based on the item properties.

- Produce Properties being the filters that include or exclude tracking entries for value posting.

Each of these is explored in more detail below.

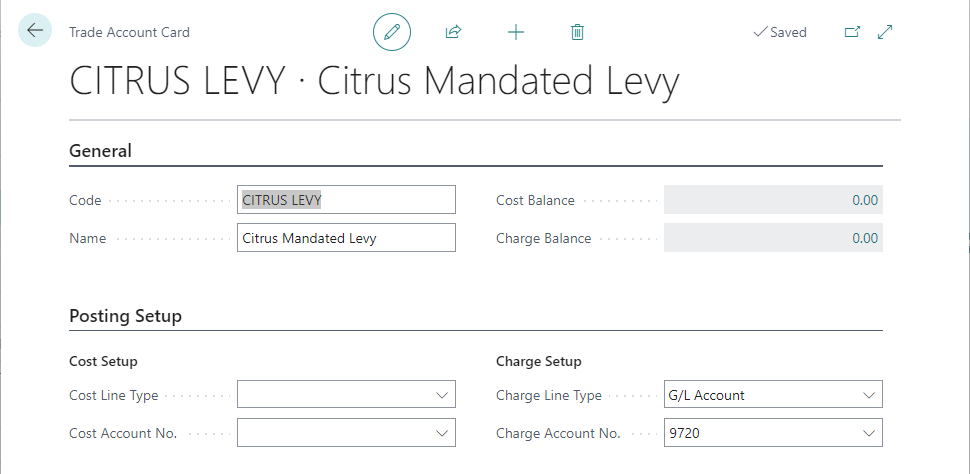

Trade Accounts

Trade Accounts are used to define the different types of costs, charges, and deductions that apply within a produce business. These can take the form of levies, fees, royalties, production, and logistics recoveries and any other type of costs that require tracking.

A trade account requires a code and a description which may be generic such as LEVIES, or specific such as AFFA-LEVY, depending on the level of detail you need for your posting rules and reporting.

You can define G/L accounts for costs and charges on the Trade Account that will be defaults for Produce Posting Rules (though they can be changed).

Each Produce Posting Rule will involve a trade account defined on the line.

Choose the icon, enter Trade Account and then choose the related link, or you can access trade accounts from FreshFocus Setup actions.

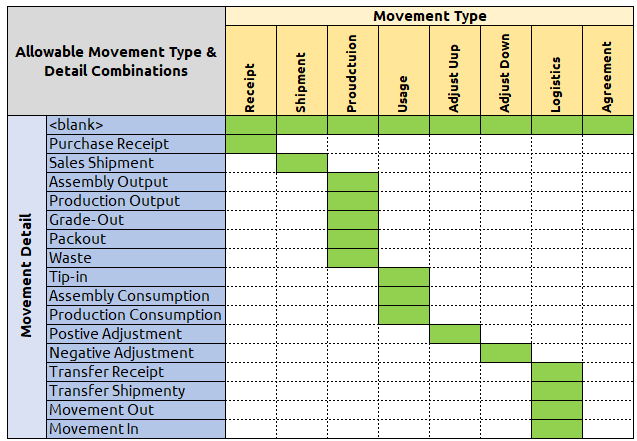

Movement Types

Movement Types act as a default filter for the type of transaction that will be included as a trigger for any rule. To achieve more granular rules, you can add Movement Detail Types to bind the movement type to specific types of transactions in Business Central. The allowable combinations are shown below.

Produce tracking entries are created when produce lots are transacted. The system records the binding lot-for-lot which is used to determine the share of produce costs and recharges to apply.

A relationship is created between the Produce Tracking Entries and the Item Ledger Entry. This relationship can be complex due to the nature of produce grading, commit-to-pack and the need to allocate and share costs across lots, and be able to trace them back to each produce agreement.

For More information see Produce Tracing.

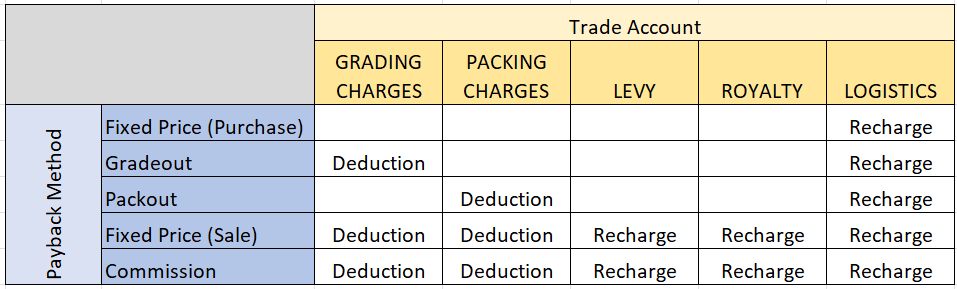

Posting Rule Treatments

Each posting rule requires a 'treatment' that defines whether the rule is deductible, rechargeable, a cost or not applicable for each payback calculation method.

This is important because some agreements with producers and suppliers may stipulate that royalties can be deducted for grade-outs, and other agreements may stipulate that the royalty is embedded in the grading price.

Using posting rule treatments you can define exactly how each agreement will work. A typical treatment for some trade accounts is represented below.

The treatments can be defined as defaults on the trade account, but are copied to each new posting rule that is created. The treatments can be modified as needed, and may apply differently based on the vendor code in the treatment. The available fields are listed below.

| Caption | Type | Description |

|---|---|---|

| Trade Account Code | Code | Specifies the trade account that this treatment applies to. |

| Posting Rule Code | Code | Specifies the posting rule code that this treatment applies to. If blank the treatment is a default for the trade account. |

| Payback Method | Enum | Specifies the payback calculation method that this treatment applies to. |

| Vendor No. | Code | Specify a vendor code if this treatment is for a specific vendor. |

| Produce Value Type | Option | Specifies for this treatment whether the posting rule is considered a cost, charge, or deduction. |

| Line Type | Option | Defines the type to use in connection with the Account No. Field |

| Account No. | Code | Specifies the Account to which charges are to apply. |

| Treatment ID | Integer | This field is used internally and system generated |

You can access the default treatments from the Trade Account card or on each Produce Posting Rule, in either case choose Treatments from the action ribbon.

IMPORTANT

At least 1 treatment must be defined for each trade account (as a default) or posting rule. If a treatment is not defined the produce tracking engine will ignore the rule, and not create produce value entries. For this reason, a check is performed when activating rules.

Rates and Calculations

For each posting rule, a Calculation Formula is chosen, and a Rate per for that calculation formula must be specified.

The Calculation Formula field specifies how the rate is to be applied against the posting rule. It is important that the unit cost and this calculation formula are setup correctly. For example if 'weight (related UOM)' is selected, then ensure that the item's base unit of measure has a weight defined.

All the calculations and rates are applied against the Produce Tracking Entries that have been created by the system. The available calculation formulas are below

| Calculation Formula | Method | Description |

|---|---|---|

| Quantity | Produce Tracking Entry.Quantity | The Rate per is independent of the unit of measure of the item, and simply multiplied by the tracking quantity. |

| Weight (Related UOM) | Produce Tracking Entry.Quantity * Item Unit of Measure.Weight | To use this method you must specify a weight on the units of measure for the item. Normally the weight is given in kilograms, so the rate should represent KG. For example a C12 carton of apples will nominally weigh 12kg, this should be entered as weight 12 against that defined item unit of measure code. The weight is multiplied by the tracking quantity and Rate per. |

| Cubage (Related UOM) | Produce Tracking Entry.Quantity * Item Unit of Measure.Cubage | To use this method you must specify a cubage (lwh) on the units of measure for the item. If entering dimensions in metres, then the cubage will be m3 and the rate then should be in m3. For example a Z-Carton for 18KG apples has dimensions of 0.497m x 0.329m x 0.258m the cubage will calculate to 0.04219m3, then multiplied by the tracking quantity and the Rate per. |

| Flat Rate | 1 | For each Produce Tracking Entry the Rate Per is applied irrespective of the tracking quantity. |

| % of Purchase Value | Sum of Produce Agreement Invoice Detail Line.Line Amount (LCY) where Entry Type is Payback or Deduct | This special calculation formula is utilised in the Produce Agreement Invoicing process, once the Unit Cost (net of deductions) is known. You define a movement type of agreement along with a Trade Account and percentage. When a produce Agreement invoice is created, the charge is applied by adding a new 'Recharge' into the Produce Agreement Invoice Detail Line. |

| % of Sales Value | Sum of Produce Agreement Invoice Detail Line.Sales Amount (LCY) | This special calculation formula is utilised in the Produce Agreement Invoicing process once the Sales Amount is known. You define a movement type of agreement along with a Trade Account and percentage. When a Produce agreement is created, the charge is applied by adding a new 'Recharge' into the Produce Agreement Invoice Detail Line. |

The Calculation Formulas are extensible so your Partner can add additional calculation methods See developer guide.

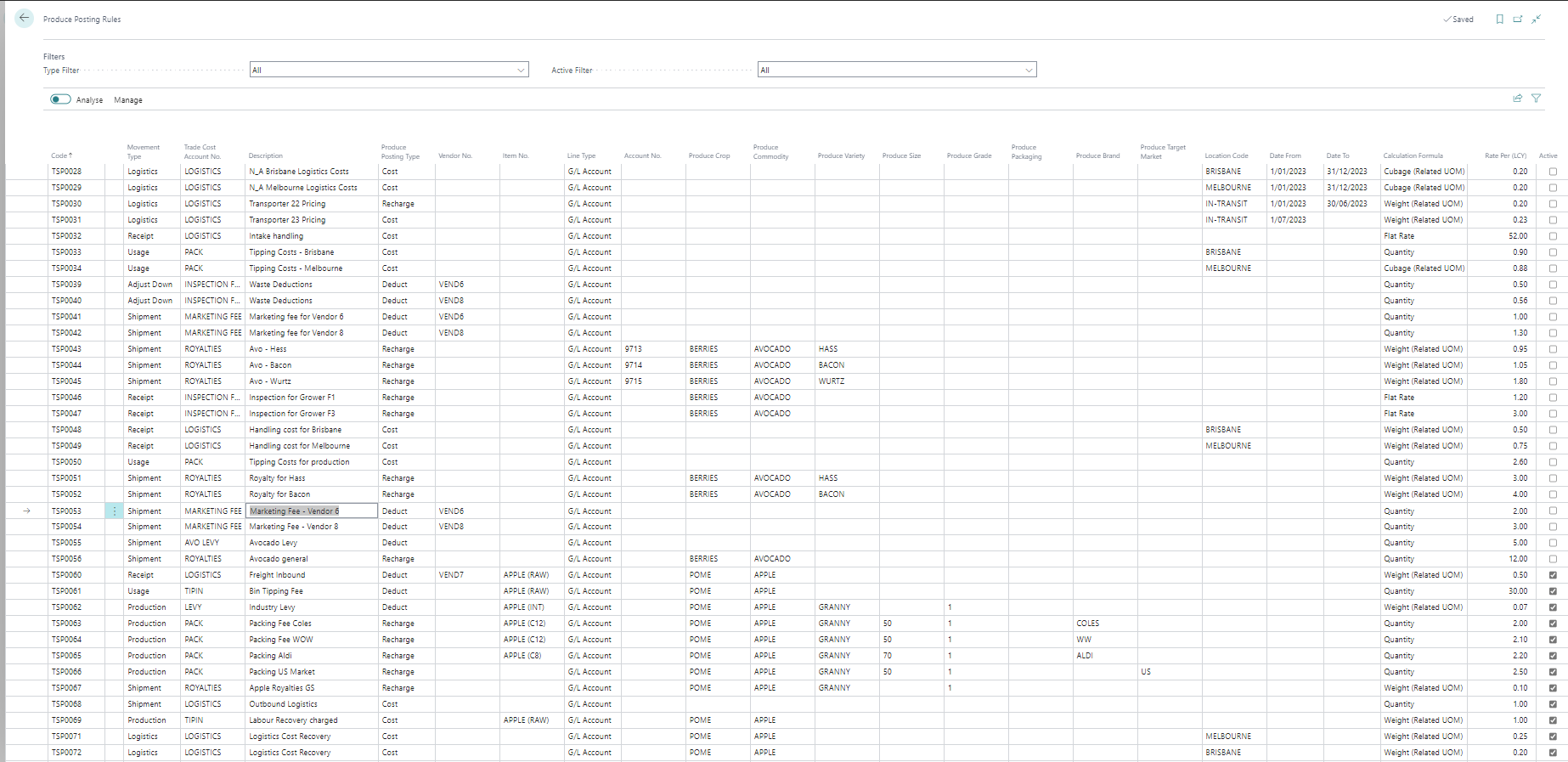

Work with Produce Posting Rules

Once your Trade Accounts have been defined, you can create your Produce Posting Rules. Choose the icon, enter Produce Posting Rules and then choose the related link, or you can access Produce Posting Rules from FreshFocus Setup actions. Click on the image to zoom in.

Posting rules can be setup in advance and activated when needed, by clicking the Activate field. You can use the Table Reference to learn more about the fields in the Product Posting Rule Table.

A description on how various fields operate is provided below.

How Posting Rules are Applied

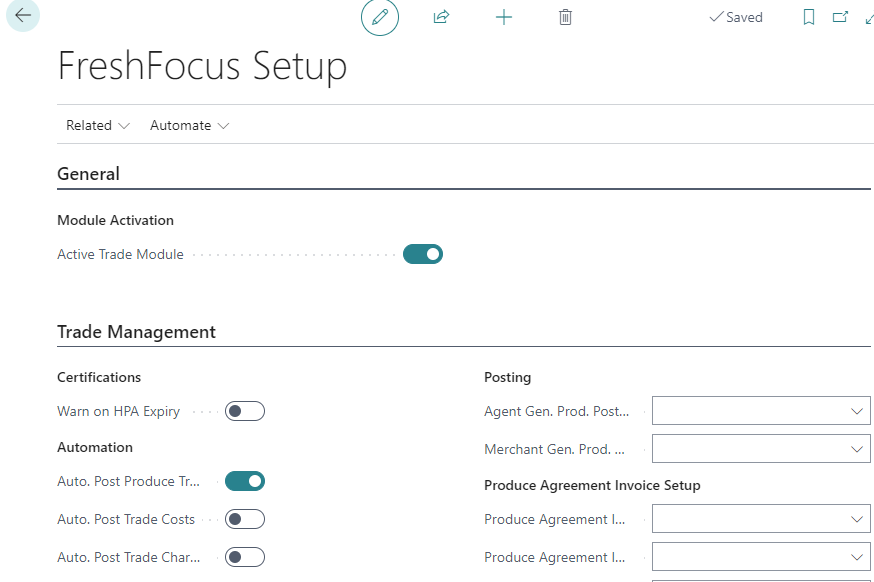

Rules are assessed each time a produce transaction is posted in the system. The resulting produce value entries can be posted automatically if the Auto-Post Produce Value field is set in FreshFocus Setup. The default value is true for this field.

Example

Assume the following Produce Posting Rules have been defined1. Note: not all fields need to be filled-in; a blank field will mean no filter is applied to that field.

| Rule Code | Movement Type | Trade Account No. | Produce Posting Type | Commodity | Location Code | Calculation Formula | Rate per |

|---|---|---|---|---|---|---|---|

| A | Shipment | LOGISTICS | Cost | A | Cubage (Related UOM) | 40.00 | |

| B | Usage | TIPPING | Recharge | APPLES | Quantity | 8.50 | |

| C | Shipment | LEVY | Deduction | ORANGES | Weight (Related UOM) | 0.85 |

The following Produce Tracking Entries have been created by the system. Note: Shipment entries 1 & 2 are received together, and constitute 1M3 in proportion to their carton sizes.

| Entry no. | Movement Type | Item No. | Lot No. | Quantity | Unit of Measure |

|---|---|---|---|---|---|

| 1 | Shipment | APPLE C12 | Lot A | 50 | C12 |

| 2 | Shipment | ORANGE B8 | Lot B | 50 | B8 |

| 3 | Usage | APPLE RAW | Lot C | 12 | BIN |

The resulting Produce Value Entries will be created upon posting.

| Entry No. | Trade Account No. | Produce Posting Type | Lot No. | Quantity | Unit Cost (LCY) | Line Amount | Tracking Entry |

|---|---|---|---|---|---|---|---|

| 1 | LOGISTICS | Cost | Lot A | 0.67 | 40.00 | 26.67 | 1 |

| 2 | LOGISTICS | Cost | Lot B | 0.33 | 40.00 | 13.33 | 2 |

| 3 | LEVY | Deduction | Lot B | 400 | 0.85 | 340.00 | 2 |

| 4 | TIPPING | Recharge | Lot C | 12 | 8.50 | 102.00 | 3 |

In this example, the cubage charge is shared between Lots A & B based on the common unit being cubage C12 and C8 units.

Tip - Auto-Post in FreshFocus Setup

When first validating the system, its advised to manually check the application of produce posting rules in the produce value journal.

Once you are satisfied that the rules are working as expected, you can post the journal, and then set the auto-post fields in FreshFocus.

Produce Posting Rule Field Descriptions

Fields can be displayed or hidden using the page personalisation features of Business Central.

Note

Fields marked (optional) when left blank apply to all records that match that field. For example, if Vendor No. is left blank then the rule applies to all vendors. If a value is set then the rule applies ONLY to that Vendor No.

| Caption | Type | Description |

|---|---|---|

| Code | Code | Specifies the unique identifier for the produce posting rule. See No. Series in FreshFocus setup. |

| Movement Type | Option | Specifies the movement type that this produce posting rule applies to. |

| Movement Detail | Option | (optional) Specifies a detail movement type for the rule. Using this field you can narrow down to an entry type for the rule. |

| Trade Account Code | Code | Specifies the trade account that this produce posting rule applies to. |

| Parent Rule Code | Code | Specifies the another posting rule code that is a parent to this record. When the rules are assessed the child rules are selected if they are a better match. |

| Description | Text | Specifies a description for the produce posting rule, the trade account number description will be used as the default. |

| Item No. | Code | (optional) Specifies item no. that this rule applies to. |

| Variant Code | Code | (optional) Specifies the item variant code that this rule applies to. |

| Location Code | Code | (optional) Specifies the location code that this rule applies to. |

| Bin Code | Code | (optional) Specifies the bin code that this rule applies to. |

| Date From | Date | (optional) Specifies the date from which the produce posting rule applies. Produce tracking entries made on or after this date will be considered by the rule. |

| Date To | Date | (optional) Specifies the date when the produce posting rule expires. Produce tracking entries made on or before this date will be considered by the rule. |

| Calculation Formula | Option | Specifies how the rate is to be applied against the posting rule. It is important that the unit cost and this calculation formula are setup correctly. For example if ''weight (related UOM)'' is selected, then ensure that the item's base unit of measure has a weight defined. |

| Rate | Decimal | The value in this field specifies the rate that applies to the specific rule and its filters. The unit of this field correlates to the Calculation Formula. |

| Active | Boolean | Set this field to activate the rule. |

| Retrospective Ignore Point | Integer | This field is used internally by the program, and is set when a rule is activated. Tracking entries greater than the last entry defined by this field will be considered. When used in conjunction with the starting date, it can ensure value entries are created if processing has occurred but a posting rule was not created in time. |

| Producer | Code | (optional) Specifies the producer code that this rule applies to. |

| Producer Site | Code | (optional) Specifies the producer site that this rule applies to. This would normally be used in conjunction with the producer code to narrow down the rule. |

| Producer Block | Code | (optional) Specifies the producer block that this rule applies to. This would normally be used in conjunction with the producer and site to narrow down the rule. |

| Produce Crop | Code | (optional) Specifies the produce crop that this rule applies to. |

| Produce Commodity | Code | (optional) Specifies the produce commodity that this rule applies to. This would normally be used in conjunction with the crop code to narrow down the rule. |

| Produce Variety | Code | (optional) Specifies the produce variety that this rule applies to. This would normally be used in conjunction with the crop and commodity code to narrow down the rule. |

| Produce Size | Code | (optional) Specifies produce size that this rule applies to. |

| Produce Grade | Code | (optional) Specifies the produce grade that this rule applies to. |

| Produce Processing Facility | Code | (optional) Specifies processing facility that this rule applies to. This would normally be used in conjunction with tracking entry types that relate to production. |

| Produce Packaging | Code | (optional) Specifies the packing code that this rule applies to. |

| Produce Brand | Code | (optional) Specifies produce brand code that this rule applies to. |

| Produce Target Market | Code | (optional) Specifies the target market code that this rule applies to. This can apply to both inbound and outbound tracking entries. |

| No. of Treatments | Integer | Shows how many active treatments are been defined for the current rule |

Activating Produce Posting Rules

Produce Posting Rules support start and end dates (Date From / Date to) that define the period where the rule should apply. These dates use the posting date of the tracking entries and could be different from the posting date of the related item ledger entry if auto-post tracking is turned-off.

The FreshFocus tracking engine only considers active rules when posting, and rules can be deactivated as required.

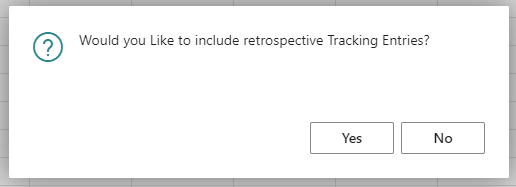

FreshFocus also provides the ability to apply rules retrospectively in combination with the 'from' and 'to' dates. When a rule is 'activated' you will be asked whether the rule should apply to retrospective tracking entries.

if 'Yes' is selected, then the Retrospective Ignore Point field for the selected Produce Posting Rule is set to zero (ie apply the rule to all tracking entries).

If 'No' is selected, then the Retrospective Ignore Point is set to the last tracking entry in the system, and only tracking after this entry is included.

To change the setting you can deactivate and reactivate the rule, using the from and to dates to ensure your posting rules only apply when you want them to.

More Information

Once your Produce Items, Trade Accounts and Produce Posting Rules have been defined, the system can begin assigning costs, deductions and recharges to the tracking that is created from Produce Agreements.

For more information on the tracking see Traceability and for configuration options see FreshFocus Setup.

See Also

-

The table below shows only some of the fields that you can select from. ↩